Table of Contents

Nvidia Stock Split Details

NVDA stock recently completed a 10-for-1 stock split, which went into effect on Monday, June 10, 2024. Under the split, shareholders of record as of the close of trading on Thursday, June 6, 2024 received nine additional shares for each share they already owned.The distribution of the new shares took place after the market closed on Friday, June 7, 2024.

As a result of the split, Nvidia’s stock price was reduced to roughly one-tenth of its pre-split value. For example, with the stock closing at $1,224.40 on Wednesday before the split, it would have opened at around $122.44 per share on a split-adjusted basis.However, the split did not change Nvidia’s overall market value, which surpassed $3 trillion last week, briefly making it the second most valuable U.S. company behind Microsoft.

The primary goal of the stock split is to make Nvidia shares more accessible to a broader range of investors by lowering the price of each individual share. This could potentially attract more retail investors and increase demand for the stock. Companies with high share prices often use stock splits to manage their stock price and improve liquidity.It’s important to note that while the number of outstanding shares increased tenfold and the stock price decreased proportionately, the value of each shareholder’s total investment remained unchanged. The split did not fundamentally alter Nvidia’s valuation or financial performance.

Nvidia Stock Fundamentals

1. Dominance in AI and Data Center Markets

Nvidia’s leadership in the AI sector, particularly through its advanced GPUs, has been a significant driver of revenue growth. The company’s data center segment has seen explosive growth, with revenues increasing by 524% year-over-year to $22.56 billion in the latest quarter. This growth is fueled by the high demand for AI applications and generative AI technologies, such as those used by OpenAI’s ChatGPT and other large language models.

2. Innovative Product Offerings

Nvidia continues to innovate with new AI architectures and GPUs. The introduction of the Blackwell platform and the upcoming Rubin architecture are examples of Nvidia’s commitment to staying ahead in the AI market. The company’s GPUs, such as the H100, are highly sought after for their performance in AI and high-performance computing applications.

3. Strategic Partnerships and Expansions

Nvidia has formed strategic partnerships with major cloud service providers like Amazon Web Services, Google Cloud, and Microsoft Azure, which have significantly boosted its data center revenues. These collaborations help Nvidia integrate its AI technologies into a broader range of applications and industries.

4. Stock Split and Accessibility

The recent 10-for-1 stock split has made Nvidia shares more accessible to retail investors, potentially driving up demand and share price momentum. This move has broadened the investor base and increased market participation.

5. Growth in Automotive and Gaming Segments

While the data center segment is the primary growth driver, Nvidia’s automotive and gaming segments also contribute to its revenue. The automotive segment, which includes advanced driver-assistance systems and autonomous driving platforms, has shown significant growth, with revenues increasing by 68.47% year-over-year. The gaming segment, although now a smaller portion of total revenue, continues to grow, driven by the demand for high-performance gaming GPUs.

6. Market Leadership and Competitive Edge

Nvidia’s first-mover advantage and technological superiority in AI chips have kept competitors like AMD and Intel at bay. The company’s ability to innovate rapidly and maintain a high market share in the AI chip market (estimated at 70% to 95%) underscores its competitive edge.

7. Financial Performance and Valuation

Nvidia’s strong financial performance, with consistent earnings beats and high gross margins, has reassured investors of its growth potential. Despite its high valuation, analysts consider Nvidia’s stock to be reasonably priced given its growth prospects in the AI market.

In summary, Nvidia’s revenue growth is driven by its dominance in the AI and data center markets, continuous innovation, strategic partnerships, increased accessibility through stock splits, growth in automotive and gaming segments, competitive edge, and strong financial performance.

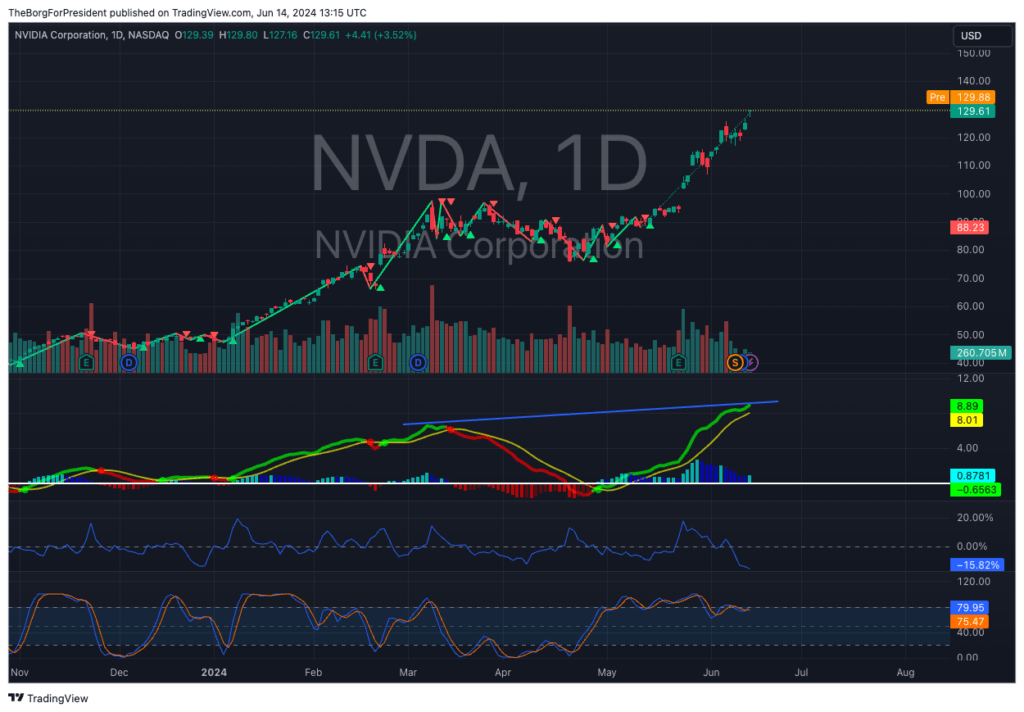

Nvidia Stock Technicals w/ Chart

Relative Strength Index (RSI)

- Nvidia’s 14-day RSI is 64.979 according to Investing.com, which is a bullish signal.

Moving Average Convergence Divergence (MACD)

- Nvidia’s MACD (12, 26) is 8.15, which is a buy signal.

- Nvidia’s MACD-EMA(MACD) is 8.9, which is considered extremely elevated. Historically, the stock has averaged a 23.6% return over the next 100 days in such cases.

Volume

- NVDA stock 30-day average daily trading volume is 68.19 million shares as of June 12, 2024. This is near the high end of its 5-year range.

- On June 12, 2024, Nvidia’s trading volume was 255.13 million shares. One of the historically high days of NVDA stock.

Moving Averages

- Nvidia’s stock price is trading above its 50-day, 100-day and 200-day simple and exponential moving averages, indicating a strong bullish trend.

Other Indicators

- NVDA stock Fast Stochastic reading is 94.1, which is abnormally elevated. The stock has historically returned 54.6% on average over the next 200 days in similar instances.

- The Commodity Channel Index (CCI) for NVDA stock is 333.7, an extremely elevated reading that has preceded a 55.2% average gain in the stock over the next 200 days in the past.

In summary, the majority of NVDA stock technical indicators, including the RSI, MACD, moving averages, and others, are giving bullish signals as of mid-June 2024. The elevated trading volume also confirms strong interest in the stock.

Sources Used for the Analysis of NVDA Stock

https://finance.yahoo.com/news/earn-500-month-nvidia-stock-142920304.html

https://www.techtarget.com/whatis/feature/Whats-going-on-with-Nvidia-stock-and-the-booming-AI-market

https://ycharts.com/indicators/nvidia_corp_nvda_automotive_revenue_quarterly

https://www.pcgamesn.com/nvidia/q4-fy-2024-earnings-report